Editor’s Note: This article was first published to HFI Research main subscribers on Jan 12, 2024. Please note that the market prices in this article will be dated as a result.

Note: Dollar figures refer to Canadian dollars unless otherwise specified.

Spartan Delta (SDE:CA) is a natural gas-weighted Canadian E&P with assets in the Deep Basin in Alberta. The company’s assets reside in the Cardium, Spirit River, and Duvernay formations. It produces approximately 39,500 boe/d and has 45,000 boe/d of infrastructure capacity.

Management estimates that SDE has nearly 800 drilling locations, enough to last nearly four decades at current drilling rates. At the end of the third quarter, the company had $65 million in net debt. It has an enterprise value of $590 million.

We consider SDE to be one of the most attractive equity investments among North American natural gas-weighted E&Ps. The company maintains significant liquids exposure, which provides upside amid higher oil prices. Its production mix ensures cash flow generation at low commodity prices and high capital efficiency among gas-weighted E&Ps. We rate the shares as a Buy and initiate a $4.00 price target.

Spartan Delta's Background

SDE was formed in 2019 by Richard McHardy and his team. Before Spartan Delta, McHardy led three previous Spartan entities, including Spartan Exploration in 2011, Spartan Oil in 2011-2013, and Spartan Energy in 2013-2018.

McHenry grew SDE from 250 boe/d in 2019 to 80,000 boe/d in 2023. Most of the growth came from acquisitions when assets and businesses were priced at a discount due to low prevailing commodity prices.

SDE’s first major acquisition was Bellatrix, which it acquired in April 2020 in the depths of the pandemic-related downturn for $102.2 million. The acquisition increased SDE’s production to 25,000 boe/d, 30% of which was oil.

In March 2021, SDE acquired three private companies that were producing a combined 9,700 boe/d for $147.9 million. These acquisitions increased the company’s scale in the Montney, namely in the Gold Creek, Simonette, and Willesden Green sub-basins. Then in August, it acquired privately-held Velvet Energy for $751.5 million. Velvet was producing 20,600 boe/d in the Montney, consisting of 42% oil, 42% NGLs, and 44% natural gas. Velvet had a multi-decade reserve life, which allowed SDE to use its technical expertise to build value organically.

SDE paused its acquisition spree in 2022. It focused instead on integrating its assets and used the cash flow from high commodity prices to pay down debt. By September, it had fully repaid its revolving credit facility.

In November, SDE’s board of directors announced it was evaluating strategic repositioning alternatives to enhance shareholder value. The company possessed multiple decades of drilling inventory and more than $2 billion of tax pools. It forecasted 80,000 boe/d of production in 2023 and planned to grow production by 10% annually over the coming years. Given SDE’s prospects, management believed its $2.5 billion market cap undervalued the company’s equity. It sought a catalyst to unlock shareholder value.

That catalyst arrived in March 2023 in the form of SDE’s sale its Gold Creek and Karr Montney assets to Crescent Point Energy (CPG) for $1.7 billion. The deal’s proceeds were distributed as a $9.50 per share dividend to SDE shareholders.

In conjunction with the CPG asset sale, SDE announced that it would also transfer 4,000 boe/d of production to a newly created entity that would develop its Montney assets. The entity was called Logan Energy (LGN:CA) and was to be spun off as a standalone public company. SDE shareholders would receive one share of Logan Energy and one non-transferable purchase warrant for one Logan Energy share. Management estimated Logan’s net asset value at the time to be $0.35 per share. Richard McHardy, then SDE’s Executive Chairman, joined Logan as President and CEO. We profiled the company here.

Since its founding in 2019, SDE has distinguished itself through its technical expertise. After making an acquisition, drilling results would consistently exceed management’s expectations. SDE’s production results routinely outpaced management’s guidance. Over its short life, SDE generated ample cash flow and used free cash flow to pay down the debt taken on to fund acquisitions.

Since 2019, share-price appreciation and distributions of cash and equity have resulted in a more than 300% total return for the company’s public shareholders.

Today’s Remade SDE

After SDE’s strategic repositioning, the remaining entity was left with Deep Basin assets that produced approximately 71% natural gas, 23% NGLs, and 6% crude oil and condensate. The company planned to continue its development of these assets with a focus on returning capital to shareholders. Its operations are shown in the map below.

Source: Spartan Delta January 2024 Investor Presentation.

Management released its 2024 guidance on November 28. SDE’s capital budget calls for $130 million of investment. Production is expected to be in the range of 38,500 to 40,500 boe/d, comprised of 69% natural gas, less than its current weighting of 71%. The lower gas weighting is due to plans to target the Cardium, Spirit River, and other oilier plays. Management expects oil production to increase by 17% and total production by 7%. The higher oil weighting is expected to boost capital efficiency by 20%.

In 2024, we expect SDE to pay out 70% to 75% of free cash flow to shareholders, with the remainder of free cash flow allocated to paying down long-term debt. Net debt stood at $65 million at the end of the third quarter. By year-end, SDE should be nearly net debt-free at current commodity prices. At that point, the percentage of capital distributed to shareholders is likely to increase further.

Given management’s stellar track record of delivering results for shareholders over the past few years, we’re confident SDE will meet guidance in 2024.

New Development Focus Area

SDE’s first big move after completing its strategic repositioning was to acquire prospective undeveloped assets in the West Shale sub-basin of the Duvernay for $25 million. The acreage included 400 boe/d of production that resides in some of the least-developed regions of the Duvernay.

The new acreage includes 130,000 acres concentrated in the Duvernay’s oil and condensate window that lies directly west of SDE’s existing Deep Basin. Management has remained largely mum on its development plans for the asset, as it is attempting to consolidate an area characterized by fractured ownership. The footprint of the recently acquired acreage relative to SDE’s existing Deep Basin acreage is shown below.

Source: Spartan Delta January 2024 Investor Presentation.

The land acquisition came at an attractive price, amounting to $192 per acre assigning no value to the 400 boe/d of production. Recent transactions of producing acreage in the Deep Basin are made for more than $1,000 per acre, so the purchase price is very attractive if its production prospects pan out as management expects. The acreage lies in proximity to underutilized infrastructure, which will reduce investment requirements. Management is guiding to $25 million of capex on the assets in 2024.

New play development is something we look for in our E&P investments. While exploration is a risky undertaking because it involves significant upfront costs and no guarantee of success, it offers the greatest upside for shareholders if the cost of entry to a newly discovered region is low. Shareholders also benefit when E&Ps build their assets from the ground up, as they can design infrastructure to better suit their long-term needs.

The challenge with SDE’s new acreage is that Duvernay geology tends to be more complicated than Montney and Cardium acreage. We suspect this is one of the reasons why the stock market essentially ignores the new asset in SDE’s market valuation. If the acreage can be successfully developed and is economic at current commodity prices, it can represent considerable upside value for SDE shareholders. In fact, over the long term, if development pans out favorably, the new assets could be large enough to earn SDE shares a premium valuation multiple.

Valuation

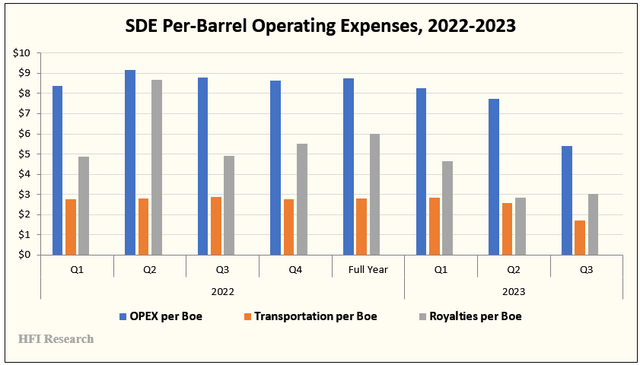

SDE is a relatively low-cost producer among its Canadian E&P peers. The chart below shows that its per-barrel operating costs are very low. In the third quarter, per-barrel operating costs registered a significant decline after the company’s asset dispositions.

SDE’s status as a low-cost producer and its heavy natural gas weighting make its cash flow far less levered to oil prices than most Canadian E&Ps. However, these features benefit the company by allowing it to generate positive cash flow at low commodity prices. When most peers are solidly in the red, with production at risk due to forced capex cuts, SDE’s operations can continue with comparatively little impact.

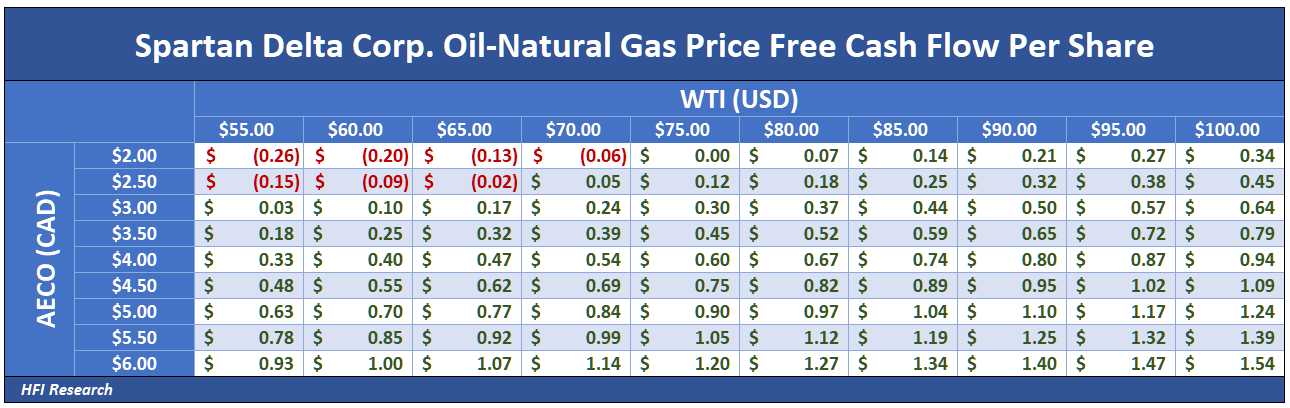

The matrix below illustrates SDE’s free cash flow per share sensitivity to oil and natural gas prices. The figures assume SDE maintains its $130 million capex budget.

Even with WTI sustained at US$60.00 and AECO at $2.00, the company could internally fund its operations by cutting back on growth capex. It would be able to maintain flat production without having to take on additional debt. At even lower commodity prices, its strong balance sheet would allow it to take on debt if necessary.

Such low commodity prices would crush the cash flows—and stock prices—of SDE’s peers. The company could respond by stepping up acquisition activity. Given its history of aggressive expansion during down cycles, we would expect it to use its balance sheet to acquire assets on the cheap during a deep energy market downturn. It would be free to pursue assets with a higher oil weighting.

Assuming normal supply-demand conditions, such low commodity prices would spur a rapid supply response among North American oil and gas producers. SDE would emerge from the downturn stronger and better-positioned than it entered and even stronger relative to peers.

SDE generates ample cash flow at higher commodity prices. With WTI at US$82.50 per barrel and AECO at $2.50, we estimate SDE generates $57.2 million of free cash flow, or $0.33 per share. If it distributes 70% of free cash flow, it could deliver $0.23 per share to shareholders. Assuming it distributes all of the $0.23 to shareholders, it would generate a 7.7% dividend yield. Alternatively, it could make large share repurchases. We would favor share repurchases, given the company’s low valuation, large holdings of prospective acreage, high-quality management, and ability to generate substantial cash flow at higher commodity prices.

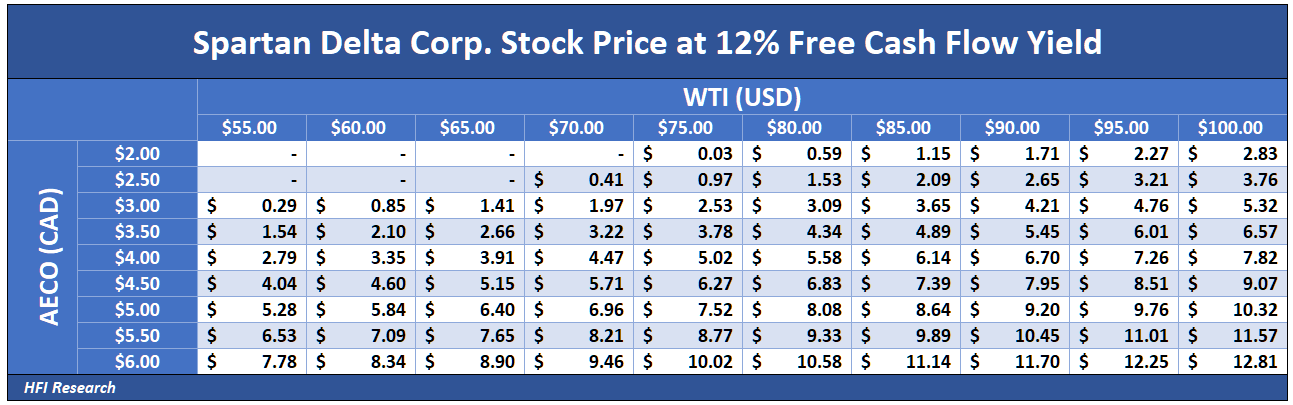

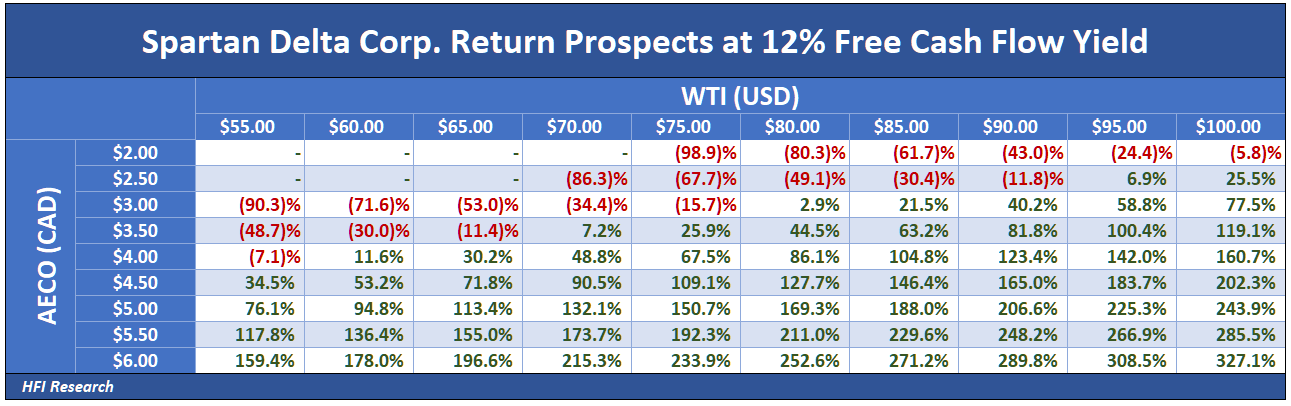

If SDE traded at a 12% free cash flow yield, which we believe is appropriate in light of prevailing interest rates, broader energy-market risks, and company-specific risks, the matrix below shows our estimates of the share price at different WTI and AECO natural gas prices.

The following table shows the shares’ appreciation potential. At the moment, the shares are discounting WTI in the low-US$70s and AECO of below $2.50. They are clearly more sensitive to changes in natural gas prices than oil prices, but they still possess roughly 50% upside if natural gas prices remain unchanged and WTI increases to US$90 per barrel.

Our valuations don’t account for the potentially significant asset value in SDE’s newly acquired West Shale Duvernay assets. This represents upside that is not recognized if the assets prove to be economic and subject to development at current commodity prices.

Conclusion

SDE’s commodity mix makes it one of the best long-term investment alternatives among North American natural gas-weighted E&P. Unlike some gassy E&P peers like Peto Exploration (PEY:CA), which have attractive natural gas assets but produce comparatively less liquids, SDE’s 30% liquids weighting increases its capital efficiency and ensures participation in oil-price upside. It also makes SDE’s production lower-cost compared to its gassier peers. And given SDE’s clean balance sheet and commitment to distribute free cash flow, its shareholders will receive the lion’s share of any cash flow windfall that occurs due to temporary or sustained increases in commodity prices.

We recommend SDE for its long-term production growth prospects, robust cash flow generation, unique commodity mix, and high-quality management. We are initiating our coverage with a $4.00 price target. Given the currently depressed sentiment in the natural gas market, SDE shares represent an attractive purchase today.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.