(Idea) Ring Energy

Ring Energy (REI) is a $300 million market cap Permian-focused E&P. Ring is unusual for a Permian operator because it targets conventional reservoirs instead of the unconventional shale source rock targeted by public Permian E&Ps. Ring’s strategy results in a low base decline and greater cash flow torque to oil prices.

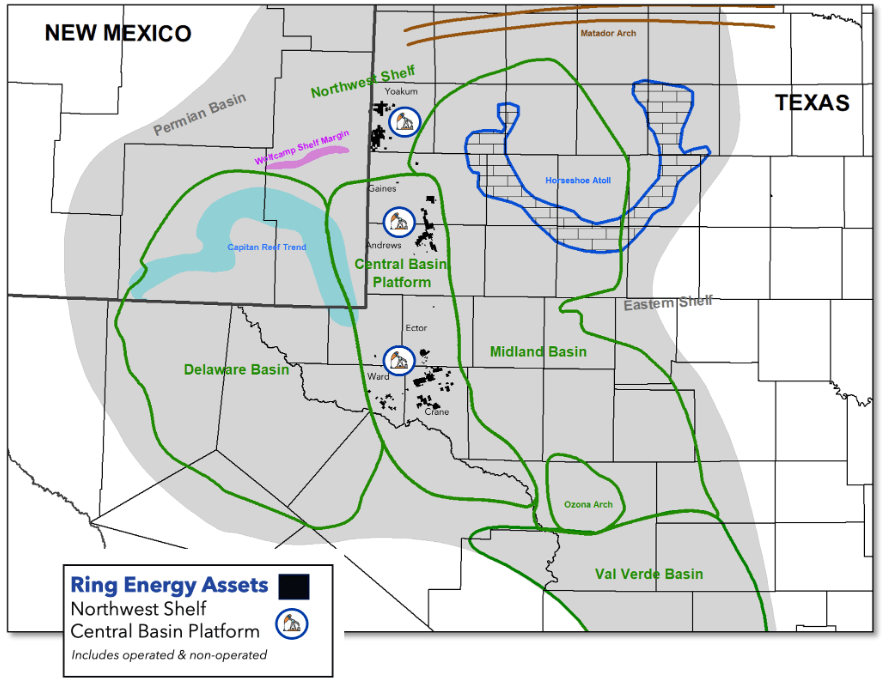

Ring’s assets are located in the Permian’s Northwest Shelf and Central Basin Platform. These are shallow carbonate reservoirs, not the deeper shale variety. They have been prolific producers of oil since they were discovered in the 1920s.

Ring’s assets are pictured below.

Source: Ring Energy website.

Aside from Ring’s strategy of targeting conventional reservoirs, it drills less expensive wells than its shale-focused peers. Its wells are both horizontal and vertical, but they’re not fracked. The combination of low production declines and low costs allows the company to be flexible in responding to changing commodity prices.

One of the Permian’s Highest Oil Weightings

Ring should be bought solely for its exposure to crude oil prices. Its location in the Permian allows it to capture nearly 100% of the WTI price, but regional natural gas gluts cause its natural gas realizations to fall to slightly above 50% of Henry Hub on a gross basis. While that situation alone is not a problem, the company’s agreements with midstream natural gas processors call for fees to be netted from revenue. After subtracting these fees, the company’s natural gas realizations fall below 20% of Henry Hub.

Natural gas liquids (NGLs) are also glutted in the basin, which causes Ring’s realizations to suffer. We expect Permian NGL production volumes to continue increasing at a higher rate than crude oil volumes, keeping NGL prices depressed. Ring shareholders shouldn’t expect much profitability from the company’s natural gas and NGL sales.

Ring’s reserves possess an unusually high weighting toward crude oil for a Permian E&P. Its 2023 reserves were comprised of 63% crude oil, as shown below.

Its production is even more heavily weighted toward oil than its reserves. In the first quarter, the company produced 70% crude oil, 14% natural gas, and 15% NGLs. Full-year guidance is the same. Accelerating the production of high-value crude relative to the low-value natural gas and NGLs is consistent with management’s strategy of prioritizing its highest-return drilling opportunities. Doing so makes sense due to oil’s outsized impact on Ring’s revenues relative to natural gas and NGL per unit of production.

But the consequence of the accelerated crude production is a shorter crude oil reserve life relative to other products at first-quarter production rates. Still, Ring’s crude oil reserves extend more than 16 years, which is longer than most of its shale-producer peers. The table below shows Ring’s reserve life for each product.

Ring’s PDP NAV per share—a proxy for liquidation value available for shareholders—stands at $3.72, 140% above Ring’s stock price of $1.54 after its recent selloff. Such a discount is rare among healthy North American oil-weighted E&Ps, and in light of Ring’s repeatable drilling results and long-lived reserves, it serves as a margin of safety for shareholders. Notably, management has succeeded in growing PDP NAV per share since 2020. Values are shown in the table below.

Ring’s 2023 reserve value incorporated conservative price assumptions of $74.70 per barrel oil and $2.64 per mcf natural gas. The high PDP NAV per share registered in 2022 was attributable to the $6.36 per MMBtu natural gas price and $90.15 per barrel oil price used to calculate PV-10 that year. It also benefited from a 27% lower share count that prevailed before Rings’ preferreds were converted into common shares.