(Idea) Diversified Energy

Editor’s Note: Diversified Energy is an interesting name. Jon Costello, head of “Ideas from HFI Research”, and I disagree on this name. I don’t find this name attractive at all. Asset retirement obligations make this name have very limited upside unless natural gas prices skyrocket. It’s a very binary situation. I recommend readers to read the write-up and come to your own conclusion.

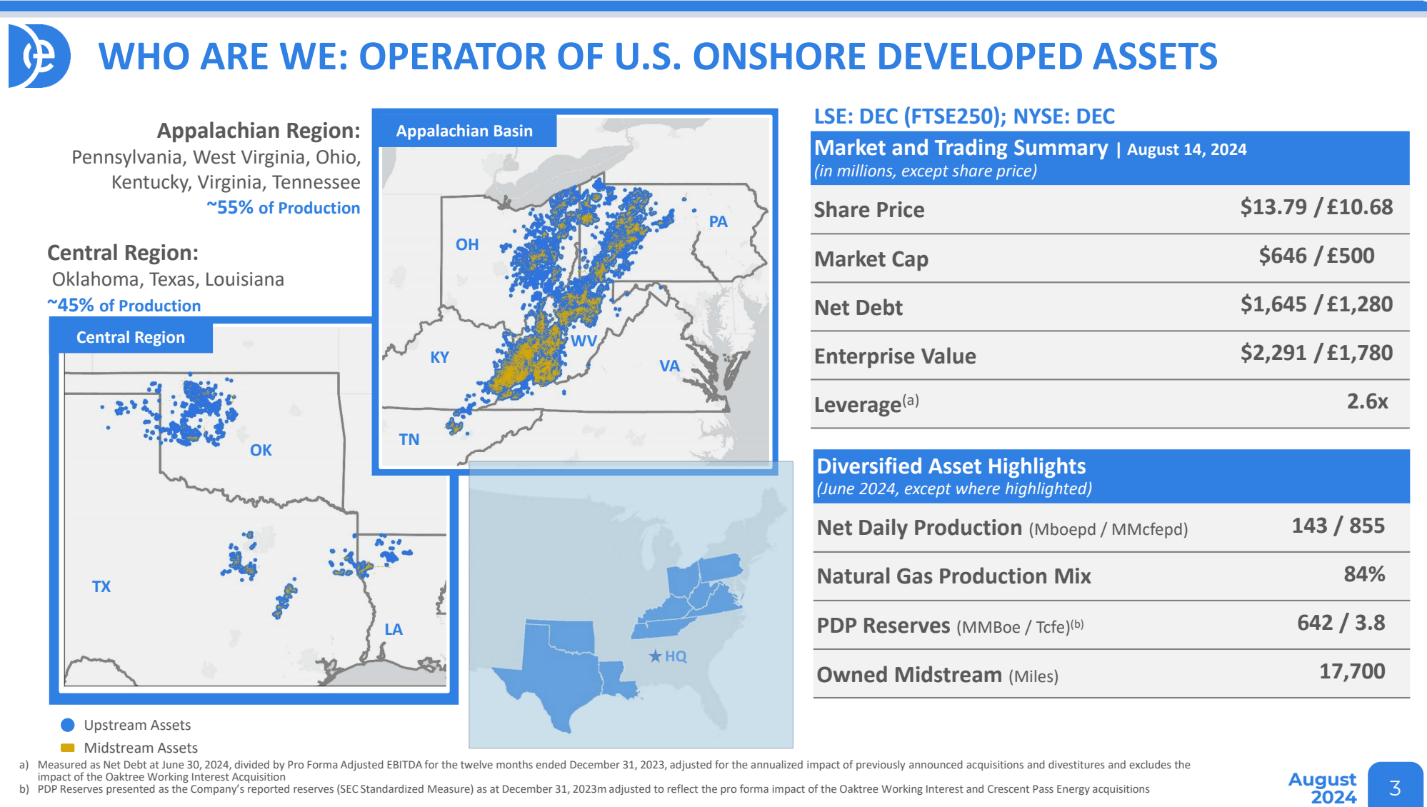

Diversified Energy Company (OTCQX:DEC) is a rare bird in the energy sector. The company is engaged in acquiring and managing proved, developed, and producing (PDP) oil and gas reserves. It focuses primarily on natural gas, with approximately 86% of its production weighted toward gas and the rest toward liquids, mostly NGLs. While it operates in most producing regions in the U.S., its assets are concentrated in Appalachia and in the Midcontinent.

Natural gas wells gas wells can produce profitably for over a decade. Seasoned wells like these are known as “stripper wells,” and DEC is the largest owner of these wells in the U.S., with an inventory of more than 75,000 wells located throughout the U.S.

DEC's massive asset footprint and corporate snapshot are shown below.

Source: DEC Corporate Presentation, Aug. 15, 2024.

Historically, DEC’s shares have traded on the London Stock Exchange. Its shares began trading on the New York Stock Exchange on December 18, 2023, as management expected the increased exposure and additional liquidity would boost the share price.

So far, it hasn’t turned out that way. The shares have been clobbered this year, begging the question as to whether they’ve fallen too far. The chart below shows DEC’s historical share price performance on the London Stock Exchange.

We believe the shares are indeed undervalued. However, investors must understand the unique risks, as well as the challenges involved in valuing DEC’s equity, before committing to a long-term investment in the shares.